Learning About Our Neighbors: Housing

Annabelle hopes to someday provide affordable housing through Furnishing Families, but for now, that goal stays on the vision board. The fact remains—furnishings are pointless without a living space to take them to. In this “Zip Codes” series installment, you will learn about the current assistance landscape in the Tarrant County/Fort Worth area and gain a further understanding of the life circumstances for the families we serve.

Nearly all of our served families are in a low or very low income bracket, and a large percentage have just left a shelter, domestic abuse case or homelessness. While there exists some local non-profits that help, inevitably, some form of government intervention becomes the most reliable and practical way towards a stable and successful living arrangement.

The US Department of Housing and Urban Development (HUD) remains the umbrella at the federal level of oversight. In our primary service areas, two of the main agencies through which HUD administers resources are Tarrant County Housing Assistance and Fort Worth Housing Solutions. Additionally, HUD provides project-based assistance (rent help is sourced directly through designated properties) and tenant-based assistance (renters pick a location that meets HUD’s criteria). In all these cases, assistance may range from fully to partially subsidized, depending on the case (HUD Website). All applicants are subject to screening for abuse of alcohol, drug use, and any criminal activities in an effort to promote safety and selection of “deserving” candidates (Cityscape).

Fort Worth Housing Solutions provides the biggest variety of help, overseeing both project and tenant-based assistance, as well as homeownership and family self-sufficiency programs. Recipients of a Housing Choice Voucher can use resources toward a mortgage, loan interest, property taxes, utilities, and more. Additionally, training sessions are provided for good home stewardship, budgeting, financing, rebuilding credit, and more. The seven point criteria for qualifying is strict and includes enrollment in the Voucher program for at least a year and full-time employment with a minimum income of $16,000 a year (FWHS).

Family Self-Sufficiency programs work with a client and case manager to help set (at least) 5 year career and financial goals, working together over time to meet them. The goal is to incentivize education or technical certifications so the client earns more income and pays more of their rent over time. Part of the reward for completing the multi year program includes an interest-bearing escrow account, where funds are added monthly to correlate with increasing costs of rent as income increases. These funds typically mount to at least $10,000 that can be used for any purpose after graduation such as a down payment on a home (1).

While amazing government offerings exist in the United States, the demand far outweighs the supply, especially for extremely low-income households. The National Low Income Housing Coalition (NLIHC) defines these households as those “with incomes at or below the federal poverty guideline or 30% of AMI (Area Median Income), whichever is higher” (The Gap). In light of data gathered in the 2021 American Community Survey, The NLIHC came to these conclusions (1):

The shortage of affordable rental housing primarily impacts renters with extremely low incomes. Extremely low-income renters in the U.S. face a shortage of 7.3 million affordable and available rental homes, resulting in only 33 affordable and available homes for every 100 extremely low-income renter households.

The shortage of affordable rental housing worsened during the pandemic. Between 2019 and 2021, the shortage of affordable and available rental homes for extremely low-income renters worsened by more than 500,000 units, or 8%.

Black, Latino, and Indigenous households are disproportionately extremely low-income renters and are disproportionately impacted by this shortage. Nineteen percent of Black non-Latino households, 17% of American Indian or Alaska Native households, and 14% of Latino households are extremely low-income renters, compared to only 6% of white non-Latino households.

Texas, especially, falls into the category of scarcity of availability. For rental homes that are affordable and available per 100 extremely low income renter households, Texas has 25 available (2). Of the 50 largest metropolitan areas in the USA, that disparity becomes even more exacerbated in “Dallas-Fort Worth-Arlington, TX” at 16 of these homes for every 100 of this household type (3).

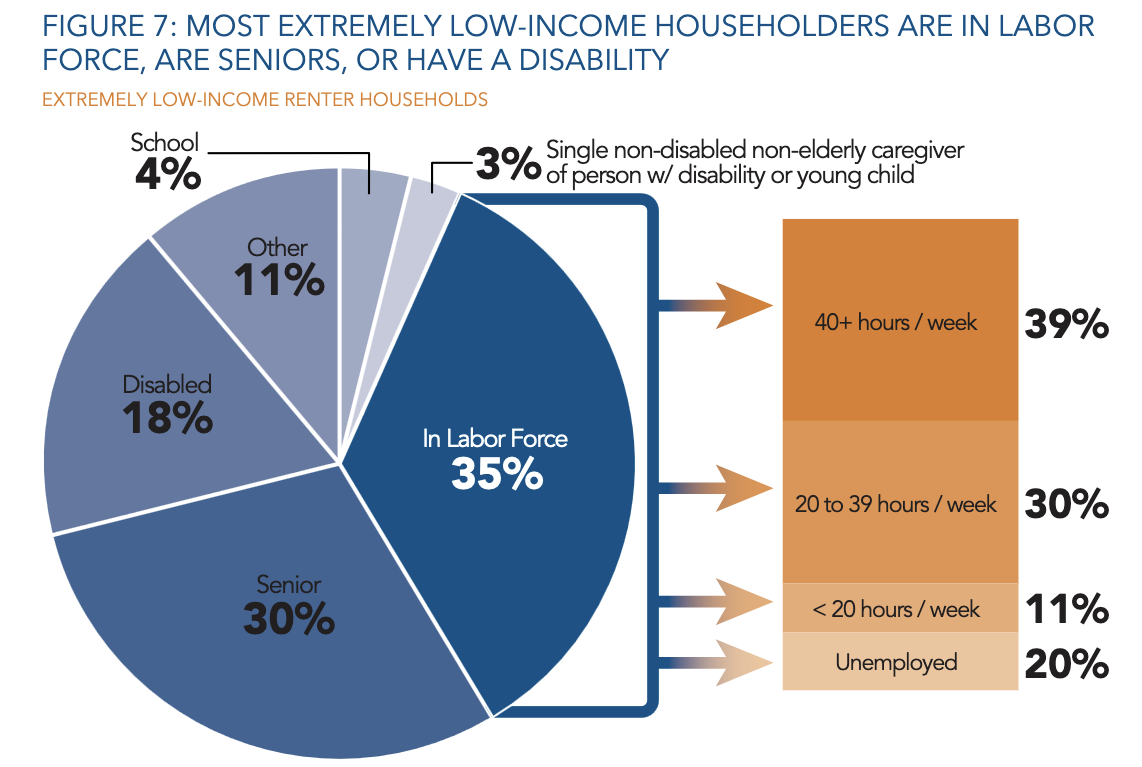

There exists a stigma that extremely low-income households are unemployed, and to a large degree this is true. About 66% are unable to work, falling into a specific category such as Senior (30%), Disabled (18%), Single Non-disabled Non-elderly Caregiver of Person with Disability or Young Child (3%), in School (4%), or Other (11%) (4). Roughly 7% are simply unemployed (20% of the Labor Force group), and 13.65% of low-income householders work 40 hours a week in low wage earning jobs (39% of Labor Force group) (5). The figure below is compiled by the NLIHC using the 2021 American Community Survey (ACS) Public Use Microdata Sample (PUMS) (6).

Because of the affordable housing shortage, when new single family properties are built, higher income households snatch them up first. The National Low Income Housing Coalition (NLIHC) proposes an array of legislative approaches to this, such as: increased funding from congress for HUD programs, changes in local and state zoning laws to incentive programs for high density living spaces to be built, and legal renter protections to prevent tenants with subsidized income to be turned away by landlords (7).

There is, of course, a place for government intervention. In direct and indirect ways, Furnishing Families collaborates with local government programs and agencies. Our case worker Terri Byrd has connected many of our families with help, such as house placement or disability assistance. Case workers from other non profits regularly ask us to help provide the beds, furniture, etc. for client living spaces that the government subsidizes.

We do not have all the answers for this issue, but desire MORE neighborly support from the private sector and local community. Churches, volunteering, local non-profits, and organic relationship-building serve as bedrocks of long term societal stability. Furnishing Families’ future communities will provide housing, discipleship, and life-skill mentorship that can empower extremely low-income families to not only increase their income but thrive and pay it forward, as well.

We all may not be able to break national cycles of poverty and its spiritual and practical root issues, but we want to be faithful with the mission field God entrusts us. You are invited to continue following and partnering with this work to see the immediate and long term vision impact these families. In the meantime, you may consider what it looks like to love your neighbor that needs stable housing.